Offshore Trust – Preventing Issues and Staying Lawful

Offshore Trust – Preventing Issues and Staying Lawful

Blog Article

Checking out the Advantages of an Offshore Trust for Riches Protection and Estate Preparation

An offshore Trust can provide significant advantages when it comes to safeguarding your wide range and planning your estate. This strategic device not just safeguards your possessions from financial institutions but likewise gives personal privacy and possible tax obligation benefits. By recognizing just how these counts on function, you can customize them to fit your distinct requirements and worths. But what certain variables should you take into consideration when establishing one? Let's explore the essential benefits and considerations that might influence your choice.

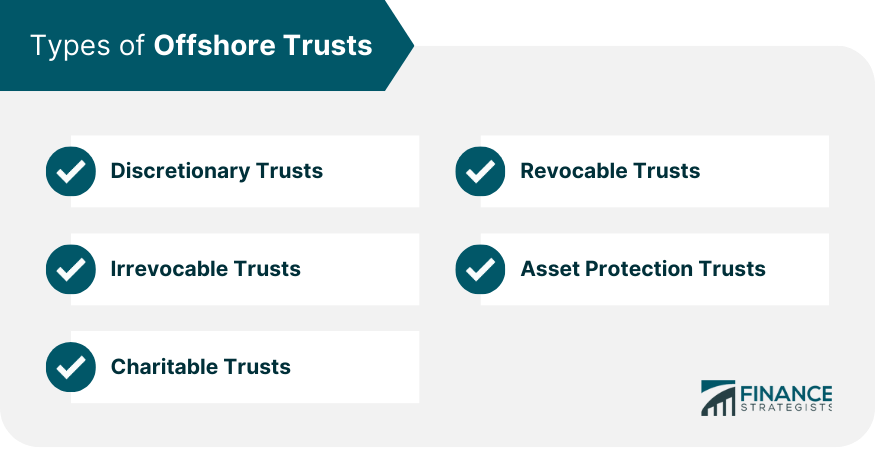

Comprehending Offshore Trusts: Definition and Basics

Comprehending offshore trust funds can be crucial when you're discovering methods to protect your riches. An offshore Trust is a lawful arrangement where you transfer your possessions to a trust handled by a trustee in an international territory. This arrangement offers numerous benefits, including tax obligation benefits and enhanced personal privacy. You maintain control over the Trust while safeguarding your possessions from regional lawful claims and prospective creditors.Typically, you would certainly establish the rely on a territory that has desirable legislations, ensuring even more robust possession protection. This suggests your riches can be protected from lawsuits or unexpected economic difficulties back home. It is essential, though, to comprehend the legal ramifications and tax duties involved in handling an offshore Trust. Consulting with an economic consultant or legal professional is sensible, as they can guide you via the complexities and assurance conformity with international guidelines. With the right method, an offshore Trust can be an effective device for guarding your riches.

Asset Defense: Shielding Your Riches From Financial institutions

When it concerns securing your wide range from lenders, recognizing the lawful framework of overseas counts on is important. These trusts provide substantial advantages, such as boosted personal privacy and discretion for your assets. By utilizing them, you can create a solid barrier against prospective cases on your wide range.

Lawful Structure Perks

While several people look for to grow their riches, securing those possessions from prospective creditors is similarly important. An offshore Trust offers a robust lawful structure that improves your possession security method. By developing your Trust in a jurisdiction with beneficial laws, you can efficiently shield your wealth from legal actions and cases. These jurisdictions often have solid personal privacy laws and minimal gain access to for exterior events, which means your properties are much less vulnerable to creditor activities. In addition, the Trust structure provides legal separation in between you and your possessions, making it harder for creditors to reach them. This aggressive technique not only safeguards your wealth however likewise guarantees that your estate preparing goals are satisfied, allowing you to supply for your loved ones without excessive danger.

Privacy and Privacy

Personal privacy and privacy play a pivotal duty in asset protection methods, especially when utilizing offshore depends on. By establishing an offshore Trust, you can keep your economic affairs discreet and protect your possessions from potential financial institutions. This implies your wealth stays much less obtainable to those looking to make insurance claims against you, providing an additional layer of security. Furthermore, lots of territories offer strong personal privacy regulations, guaranteeing your information is secured from public analysis. With an offshore Trust, you can enjoy the assurance that comes from understanding your possessions are protected while preserving your anonymity. Inevitably, this level of personal privacy not only protects your wide range however also enhances your overall estate planning method, permitting you to concentrate on what really matters.

Tax Advantages: Leveraging International Tax Obligation Regulation

When you consider offshore trusts, you're not just protecting your possessions; you're also using worldwide tax obligation incentives that can significantly minimize your tax problem. By purposefully positioning your riches in territories with desirable tax obligation legislations, you can enhance your property defense and lessen estate tax obligations. This method permits you to appreciate your riches while ensuring it's protected against unexpected obstacles.

International Tax Incentives

As you explore offshore trusts for wide range security, you'll find that global tax obligation rewards can considerably boost your monetary technique. Many territories offer beneficial tax obligation treatment for counts on, enabling you to reduce your overall tax obligation concern. Certain nations give tax obligation exemptions or lowered rates on income produced within the Trust. By purposefully placing your properties in an offshore Trust, you may additionally profit from tax obligation deferral options, postponing tax commitments up until funds are withdrawn. Additionally, some jurisdictions have no capital acquires tax obligations, which can further increase your investment returns. offshore trust. This implies you can optimize your riches while lessening tax obligation obligations, making international tax obligation incentives a powerful device in your estate preparing collection

Asset Defense Techniques

Inheritance Tax Reduction

Establishing an overseas Trust not just protects your properties but likewise provides considerable tax benefits, specifically in estate tax obligation minimization. By placing your wealth in an offshore Trust, you can make the most of positive tax laws in various jurisdictions. Lots of nations enforce lower estate tax rates or no inheritance tax whatsoever, allowing you to protect even more of your wealth for your heirs. Furthermore, because properties in an overseas Trust aren't generally considered part of your estate, you can better decrease your inheritance tax liability. This strategic step can lead to considerable savings, ensuring that your beneficiaries obtain the maximum advantage from your hard-earned wealth. Inevitably, an overseas Trust can be an effective tool for effective estate tax obligation planning.

Privacy and Confidentiality: Keeping Your Finance Discreet

Estate Planning: Guaranteeing a Smooth Transition of Wide Range

Preserving personal privacy via an overseas Trust is simply one element of riches administration; estate preparation plays an essential role in assuring your possessions are passed on according to your desires. Reliable estate planning enables you to detail exactly how your riches will certainly be distributed, lowering the threat of family conflicts or legal challenges. By clearly defining your objectives, you aid your beneficiaries recognize their roles and responsibilities.Utilizing an overseas Trust can streamline the process, as it frequently offers you with an organized method to manage your properties. You can designate recipients, define conditions for inheritance, and even outline certain uses for your riches. This critical technique not only protects your assets from potential lenders however also helps with a smoother modification throughout a challenging time. Eventually, a well-crafted estate plan can protect your tradition, offering you satisfaction that your enjoyed ones will certainly directory be cared for according to your desires.

Flexibility and Control: Tailoring Your Depend Fit Your Needs

When it pertains to tailoring your offshore Trust, flexibility and control are crucial. You can tailor your Trust to meet your details needs and preferences, ensuring it lines up with your monetary objectives. This flexibility allows you to determine how and when your possessions are distributed, giving you tranquility of mind that your wealth is managed according to your wishes.You can choose beneficiaries, established problems for circulations, and even assign a trustee that recognizes your vision. This degree of control aids guard your assets from potential risks, while also providing tax advantages and estate planning benefits.Moreover, you can adjust your Trust as your situations alter-- whether it's adding new recipients, modifying terms, or attending to changes in your economic scenario. By tailoring your overseas Trust, you not only safeguard your wealth but additionally create a long lasting legacy that reflects your worths and purposes.

Choosing the Right Territory: Variables to Consider for Your Offshore Trust

Choosing the right jurisdiction for your overseas Trust can significantly influence its performance and advantages. When thinking about alternatives, think of the political stability and governing atmosphere of the nation. A steady jurisdiction decreases dangers associated with unexpected lawful changes.Next, evaluate tax ramifications. Some jurisdictions offer tax incentives that can improve your wealth security technique. In addition, take into consideration the legal structure. A territory with strong possession protection legislations can guard your properties against possible claims - offshore trust.You need to likewise assess privacy laws. Some countries provide higher discretion, which can be necessary for your assurance. Finally, evaluate the accessibility of regional specialists who can assist you, as their expertise will certainly be crucial for handling the complexities of your Trust

Regularly Asked Questions

What Are the Expenses Related To Developing an Offshore Trust?

When developing an overseas Trust, you'll run into prices like arrangement fees, ongoing administration charges, legal expenses, the original source and prospective tax implications. It's necessary to evaluate these costs against the benefits before choosing.

How Can I Access My Assets Within an Offshore Trust?

To access your properties within an overseas Trust, you'll normally require to deal with your trustee - offshore trust. They'll lead you via the procedure, making certain conformity with laws while promoting your demands for withdrawals or circulations

Are Offshore Trusts Legal in My Nation?

You should check your nation's legislations regarding overseas trusts, as laws vary. Several countries enable them, but it's necessary to recognize the legal implications and tax obligation obligations to guarantee conformity and stay clear of possible problems.

Can an Offshore Trust Assist in Divorce Process?

Yes, an offshore Trust can potentially help in divorce procedures by safeguarding assets from being divided. Nonetheless, it's crucial to seek advice from a legal professional to guarantee compliance with your neighborhood legislations and guidelines.

What Takes place to My Offshore Trust if I Modification Residency?

If you alter residency, your overseas Trust might still remain intact, yet tax obligation effects and lawful factors to consider can vary. It's important to seek advice from an expert to navigate these adjustments and assurance conformity with laws. An offshore Trust is a lawful plan where you move your properties to a trust handled by a trustee in an international territory. You maintain control over the Trust while protecting your assets from local legal insurance claims and potential creditors.Typically, you would certainly develop the Trust in a territory that has favorable laws, guaranteeing more durable asset protection. Establishing an overseas Trust not only secures your properties yet likewise provides considerable tax benefits, particularly in estate tax obligation reduction. By positioning your properties in an overseas Trust, you're not just safeguarding them from prospective lenders but likewise ensuring your financial details continues to be confidential.These trusts operate under rigorous personal privacy laws that restrict the disclosure of your economic information to third celebrations. You can maintain control over your wide range while delighting in a layer of privacy that domestic trust funds typically can not provide.Moreover, by utilizing an offshore Trust, you can reduce the risk of identity burglary and unwanted analysis from monetary organizations or tax authorities.

Report this page